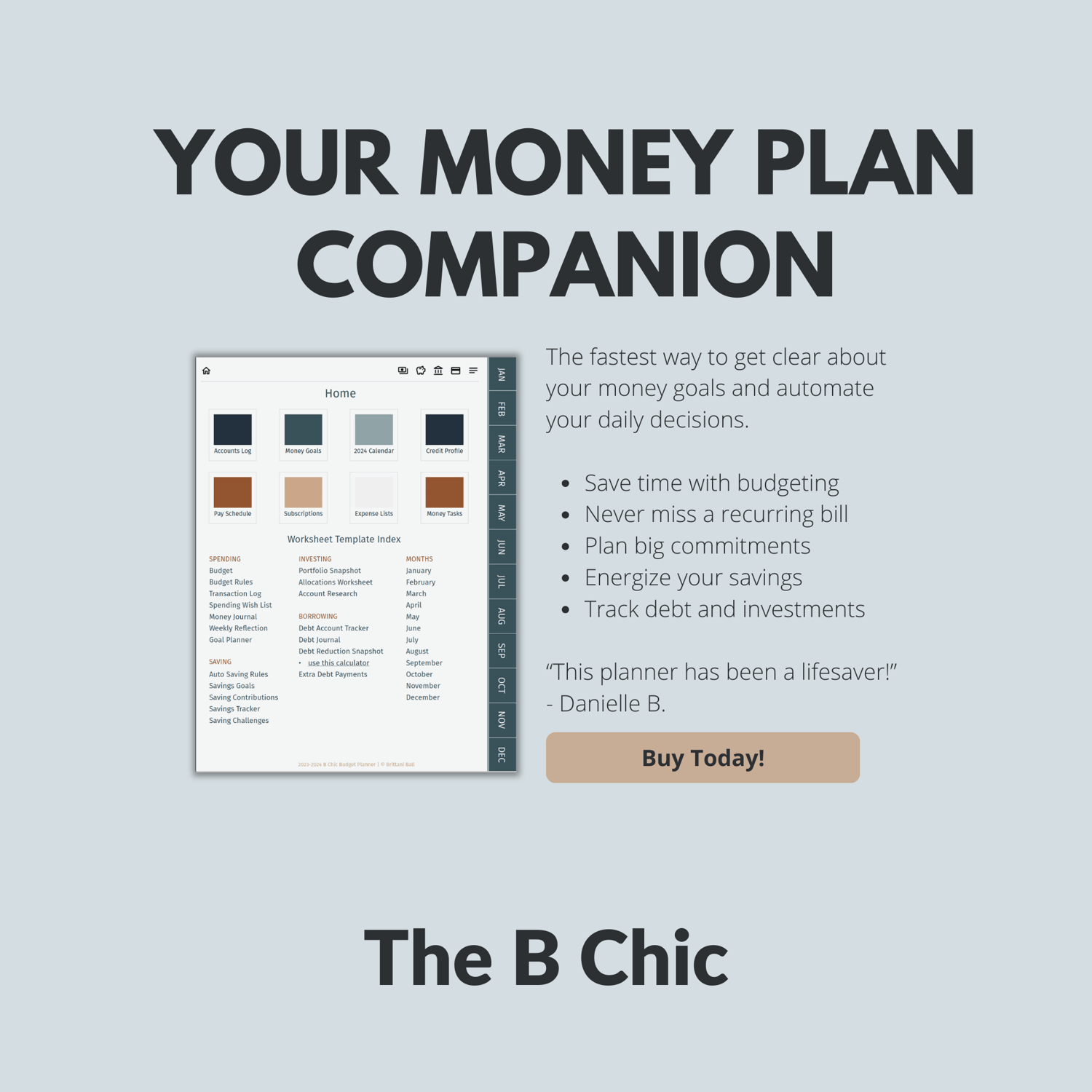

No shipping required! Upon purchase, you will have the chance to download your file. Be sure to save a copy to your own device(s) for future use. You will also receive an email backup with access to your file. Have any questions? Just email me at support@bchiccollective.com!

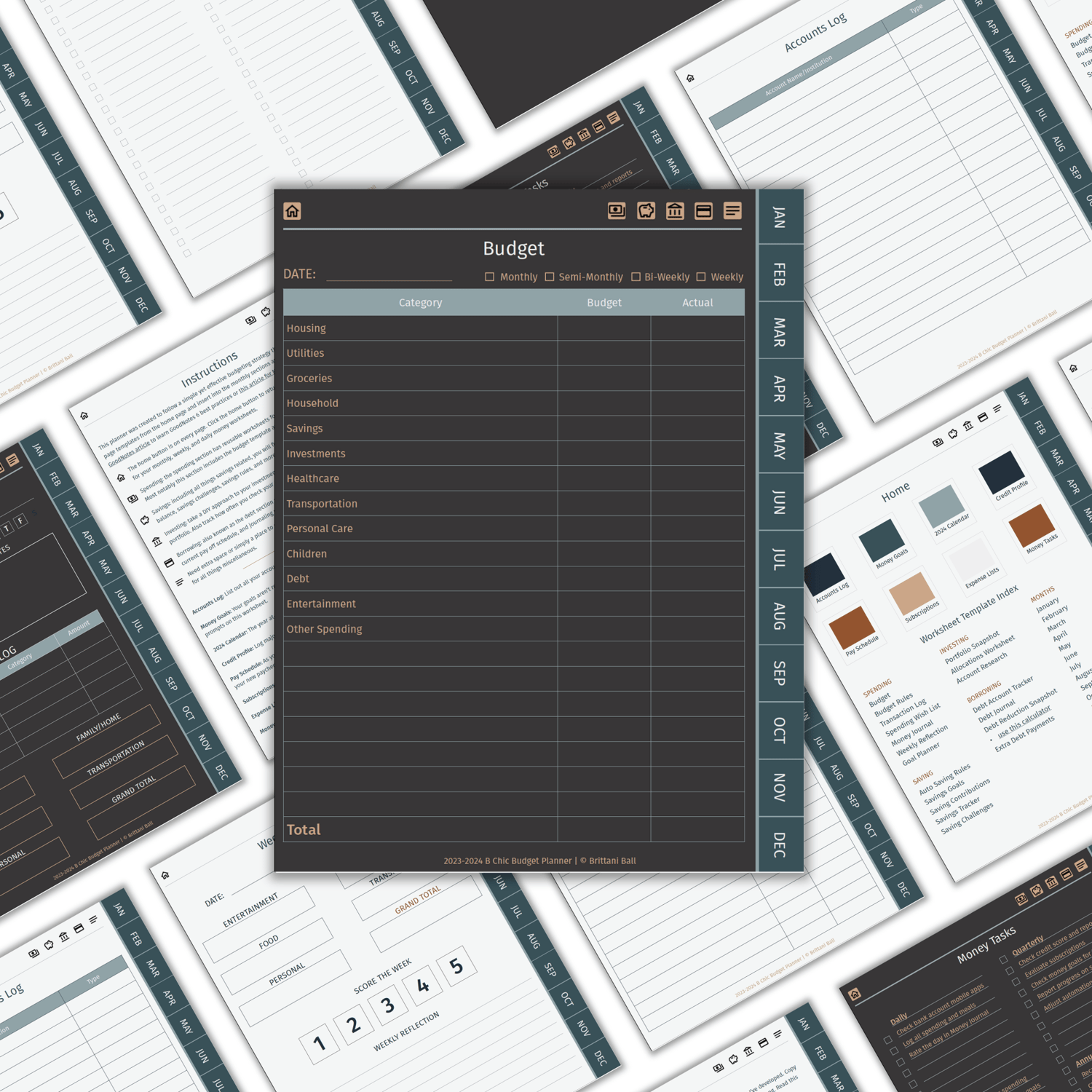

Disclosure

None of the content in this document constitutes personal investing, financial, or tax advice. This planner is for entertainment purposes only. You must invest at your own risk. If you would like personalized recommendations, please speak with a Certified Financial Professional.

Refund Policy

Given the nature of this digital product, there is a no refund policy. However, if you have any issues accessing your file or any questions regarding your order, please email us at support@bchiccollective.com.